It’s 3am in Dublin now. As Michael Maubossin highlights one of the traits of quality investor is active journaling. I just want to disclaim myself that I am no financial guru. Investing in stocks are what I have passion with and deep diving about it,keeps my sanity preserved from the chaotic world we live in today. Here I am squeezing bits of my time to scribble down whatever screaming inside my mind. At the time of writing, S&P 500 already went up 6% in 6 months and near 11% YTD. Worth to set this as benchmark as for few times in past decades,gold had beat S&P 500. I saw plenty unit trust consultants back home are advocating to deploy capital in US markets as it offers compelling returns roughly 10% p.a. There are also huge fan of gold which I barely heard from them when I first start my first gold purchase in 2014. While it may be true, somehow I have different view. I see gold as non productive assets and the only reason it goes up because of the world we live in today are having more wars than we did early 20th century.Regards to S&P 500, I didn’t favour how Trump steer the States. From chasing out the immigrants into trumpeting his irrational tariffs and all time high debt level. For stock markets to compound healthily,it must supports with sturdy employability, GDP expansion and manageable debt level. One wrong move can send America downhill.

That was not what I wish to share. Have you ever ponder and wonder? You buy a stock then the next day it goes up 5%, and then maybe 15% a month later. Of course one can’t help it but experience the feels good effect automatically sets in. You start to think how smart you are. An intelligent investor always ask prudently,

WHY MY STOCK GOES UP?

I have emphasized in my telegram channel and my small investing community that there are plenty reasons stocks moving up. Maybe company beats analyst expectation, sales are accelerating, change in boards/managers, new shareholder jump in, disposing assets, special dividends, new business ventures and so on. Those are fundamental shifts and can also plausibly be good sometimes. Most of the times, price simply reacts for no particular reasoning! No new moat, no new growth stories, no new shareholders, no buybacks, just more people willing to pay premium for the never ending speculative game.

I learn this quite late at 3rd year of investing. During my early times of investing, I always say to myself that there must be a reason why stocks go up. I spent daily digging for reasons. Yes, i learnt a lot along the way but I became exhausted too. I remember Charlie Munger advice if we are serious to compound wealth, one must stay in the game long enough. I am fortunate as I am near close to quit from market due to burnout. Quitting from the stock market just simply interrupts the compounding.

When price goes up without true organic earnings growth — This is purely multiple expansion.

Nothing wrong about being optimism but it’s always wrong to pay premium! Especially when hypes over fundamentals, company misdelivers, sectors downturns, shareholder disposing stakes etc.

It’s very easy to cheer when your stock goes up but what is even harder is to do all the hard works and stay your vision cleared. Always be intelligent ahead and recall what business are they doing? Anything changing from fundamental? Amazon was once a company selling books, it sells almost everything today! Netflix was merely a company selling DVD, now they even invest to make their own contents!

People can only wish they bought APPLE and NVIDIA 13 years ago, while in fact they never truly sit down and understand how these two grows and face plenty challenges and uncertainties. It’s the wonderful managements. Munger called them as Intelligent Fanatics. If you put your money with these fanatics, you are half way compounding your capital. Of coz the other half comes back to valuation.

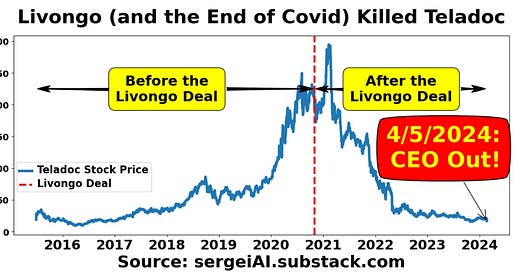

Slow and steady wins every time. If you are busy chanting your gains, you might forget to sell your position. That’s what had happened to covid investors who bet hard on Teladoc for instance.

Thank you for reading!